Table of Content

For Basic, Standard, Premier, Home & Business, Deluxe Online, Premier Online, and Self-Employed Online, technical support by phone is free. Intuit reserves the right to limit each telephone contact. Support availability subject to occasional downtime for systems and server maintenance, company events, observed Canadian holidays and events beyond our control. All of the following reviews have been submitted by actual customers who have used TurboTax Home & Business to file their taxes. TurboTax Home & Business includes an expert business interview that asks you straightforward questions to help you uncover every credit and deduction you deserve. We work hard to safeguard your information so you can file your taxes with complete confidence.

If you prefer the standard CRA forms, you can seamlessly switch over for a more traditional and familiar tax preparation experience. Get live help from tax experts, plus a final review before you file — all free. TurboTax finds every tax deduction and credit you qualify for to boost your tax refund. Finish your tax return at one time or do a little at a time and pick up right where you left off. Guides you through common life changes, big or small, and finds any new tax deductions and credits you may qualify for.

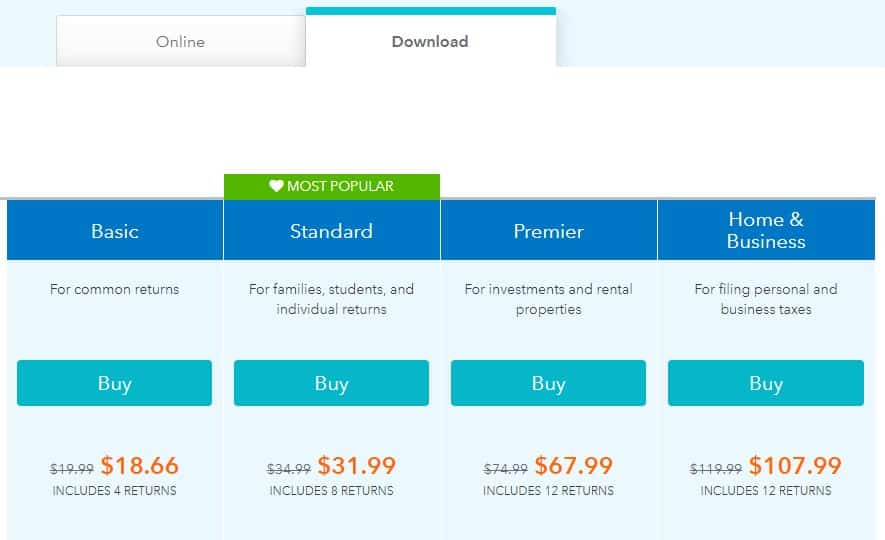

TURBOTAX ONLINE/MOBILE PRICING:

If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or state purchase price paid. See License Agreement for details. TurboTax Home & Business + State is recommended for personal and small business taxes. Includes 5 Federal e-files and 1 State via download. Free U.S.-based product support .

Product activation requires internet connectivity. You must accept the TurboTax License Agreement to use this product. TurboTax runs through thousands of error checks and double-checks your tax returns before you file so you can be confident nothing gets missed. Searches for more than 350 tax deductions and credits to get you the biggest tax refund—guaranteed. Yes you will need to purchase separate software to prepare your personal tax return.

Support

All features, services, support, prices, offers, terms and conditions are subject to change without notice. A simple tax return is one that's filed using IRS Form 1040 only, without having to attach any forms or schedules. Only certain taxpayers are eligible.

Get your personal and self-employed taxes done right. Boost your bottom line with industry-specific small business tax deductions. Creates W-2s and 1099 tax forms for employees & contractors. Up-to-date with the latest tax laws. Import W-2s, investment & mortgage information from participating companies .

TurboTax Home & Business CD/Download Reviews

E-file your federal and state tax return with direct deposit to get your fastest tax refund possible. TurboTax Online prices are determined at the time of print or electronic filing. All prices are subject to change without notice. If you have a simple tax return, you can file with TurboTax Free Edition, TurboTax Live Assisted Basic, or TurboTax Live Full Service Basic. Free filing is only available in certain products. Download option requires a free online Intuit account.

TurboTax Home & Business is a great fit for your personal return and for your corporate return, check out incorporated business edition, TurboTax Business Incorporated. TurboTax calculations are 100% accurate on your tax return, or TurboTax will pay any IRS penalties. Once you complete your federal taxes, transfer your information over to your state return . You’ll receive an email with a download code and instructions on how to redeem your purchase directly on your console or online through your console’s website. Claims are based on aggregated sales data for all NETFILE tax year 2021 TurboTax products. More than 5 million Canadians use our software to get their maximum tax refund, every single year.

Upload a picture or PDF of your W-2 or 1099-NEC to import your data securely into the right forms. Perfect for multiple sources of income, including independent contractors, freelance workers (1099-MISCs & NECs) and sales from goods and services. If the item details above aren’t accurate or complete, we want to know about it. If you want to use the desktop software, you will need to purchase at least the Deluxe version.

If you pay a penalty or interest due to a TurboTax calculation error, we will reimburse the penalty and interest. Does not include calculation errors due to errors in CRA tables. Testimonials are based on TurboTax Online reviews from tax year 2021 as well as previous tax years. Understand your tax history and know your “tax health” with suggestions to help you get an even bigger refund next year. Displays your refund in real time, so you always know where you stand.

Translates taxes into easy to answer questions about your life and puts the information in the right place for you. Audit Risk Meter™ checks your return for audit triggers and shows your risk level of a tax audit. If you or your children attended college or trade school, get education tax credits and deductions (1098-E, 1098-T) for tuition, books, and student loan interest. Spots overlooked tax deductions for your industry, so you don't miss any write-offs. Please note the delivery estimate is greater than 16 business days.

TurboTax Free customers are entitled to a payment of $9.99. Audit Defence and fee-based support services are excluded. This guarantee cannot be combined with the TurboTax Satisfaction Guarantee. If you get a larger refund from another tax preparation method, we'll refund the applicable TurboTax federal and/or state purchase price paid. The CRA typically estimates 8-14 days for electronic transmissions with direct deposit.

Simplified asset depreciation and reporting. Audit Risk Meter® checks your return for audit triggers and shows your risk level. Before you file, TurboTax runs thousands of checks to help identify missing deductions or credits. If you get a larger refund or smaller tax due from another tax preparation method, we'll refund the amount paid for our software.

Easily import W-2s, investment and mortgage information from participating companies . "Membership is required to complete an in-club or curbside pickup purchase at Sam's Club." Designed for the self-employed and small businesses, including independent contractors, consultants and freelancers.

Does not include GST/HST and other non-income tax audits and reviews unless the issues are ancillary to the income tax review itself. Includes field audits through the restricted examination of books, but does not include the "detailed financial audit". TurboTax Home & Business is for people whose business income needs to be reported on their personal tax return. If your business is incorporated, you need to prepare a personal return for yourself and a separate corporate return for your business.

No comments:

Post a Comment